ACQUIRING PROPERTY IN TURKEY

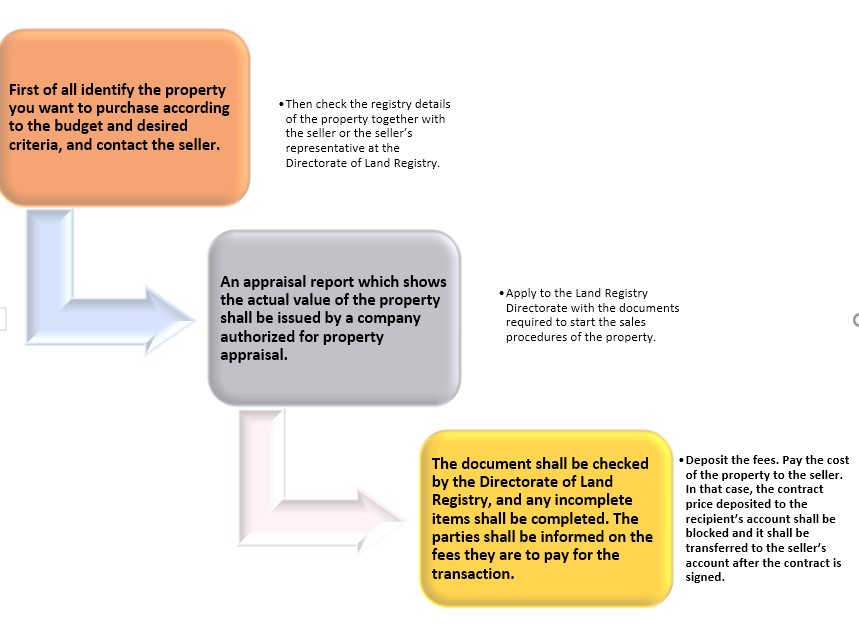

• When it comes to buy a property in a foreign country it seems complicated but with a proper legal consultancy you can make the easiest purchase.

• Finally sign the official contract issued by the Directorate of Land Registry for the sale, under the presence of the public officer, and the sales transaction will be completed when the contract is signed.

Is a residence permit required for property acquisition by foreign real persons?

Article 35 of the Land Registry Law No. 2644, amended with the Law No. 6302 specifies that “Provided that legal restrictions are complied with, foreign origin real persons who become citizens of the country as defined by the President where required for international bilateral relations and interests of the country may acquire property and limited real rights in Turkey. Real persons who are citizens of a country in the list of specified countries are not required to obtain a separate residence permit to acquire a property and limited real rights.

What are the restrictions for property acquirition by foreigners?

First of all, the country of the foreigner desirous of acquiring a property must be among the countries cleared by Turkey for property acquisition as specified in Article 35. Property acquirition by foreign real persons is only possible within the scope of legal restrictions further to Article 35 of the Land Registry Law 2644. Foreigners may not acquire properties in military forbidden zones further to the Military Forbidden Zones and Security Zones Law No. 2565. A foreign real person may acquire properties and restricted real rights of up to 30 hectares maximum. The President may increase this size up to two times. Total area of properties acquired by foreign real persons and independent and continuous limited real rights may not exceed ten percent (10%) of the surface area of the subject district of the private property. Acquisition by foreigners is not possible at the places included in strategic areas and special security zones defined by the President as areas where foreign real and legal persons may not acquire properties.

Are there any liabilities required on the part of a foreigner who acquires a land without any building?

Any foreigner who acquires a land without any building is required to develop a project on the acquired land within 2 years from the date of acquirition, and submit the project for the approval of the related ministry depending on the type of the project. The time frame for completing the project shall be determined by the relevant ministry. (Review of regulations to extend the time frame is underway).

Is the transfer of property to foreign origin real persons by inheritance possible?

Transfer of property to foreign origin real persons by inheritance is possible. However, if the transferred property is located in a zone where a real person may not acquire a property; the property is required to be sold or liquidated otherwise after the transfer. Furthermore, in the event of transfer of property by inheritance to a person who is from a country not include in the list of Article 35, the property in question must be sold or liquidated otherwise after the transfer.

How to appraise value for properties required for citizenship at land registry?

The sum of receipts evidencing payments must have a value equal to USD 250,000 according to the USD selling exchange rate of the Central Bank of Turkey on the date prior to the date of deposit. The amounts listed in the appraisal report and the official bill may not be less than the sum of values in the receipt.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

If you have any questions, please contact us.